Coffee Shop Industry Analysis : Can you outrank your competitor?

A coffee shop industry analysis main value add is to inform coffee companies on what they can do to effectively compete in this market.

For the past decade, the battle for market share has increasingly been online, coffee drinkers consume content before consuming any products. You have likely visited restaurants or cafes (product) based on an online review (content). And because of that, most of the key strategies for coffee shops are executed online, e.g. the need for coffee drinks to be instagrammable and hopefully, it can also go viral.

F&B Analytics Workshops

Sign up: Latest food and beverage analytics training

More info: Food and beverage industry market research

Coffee Market in Singapore

In the video below, we look at the coffee market in Singapore, the growth in the midst of COVID-19 and the market effort (digital marketing advert) and why the coffee niches that coffee suppliers ventured into.

So, knowing the amount of online traffic and how to compete digitally is the main objective of this study.

In this online market research, we are looking at:

- Branded Coffee Shop Market in Singapore

- Traffic leading to Coffee Consumption

- The time period from November 2019 to April 2020

Some of the questions that we hope to answer from this market study:

- Is the online traffic for coffee attractive and sustainable?

- Is there any change to the competitive landscape?

- It is possible to grow in a branded coffee shop market?

Generate your own F&B Report (Free)

Free access to generate and download food and beverage data analytics on:

- F&B industry

- Competitors stats

- Competitors advert (what they are buying and how much they are spending)

Access this platform (Free) | this is the platform that we use to generate all the reports

1. Is the Online traffic for coffee attractive and sustainable?

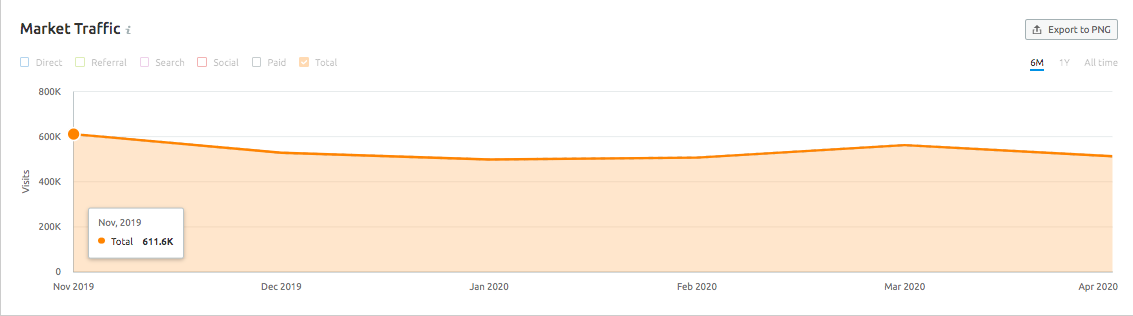

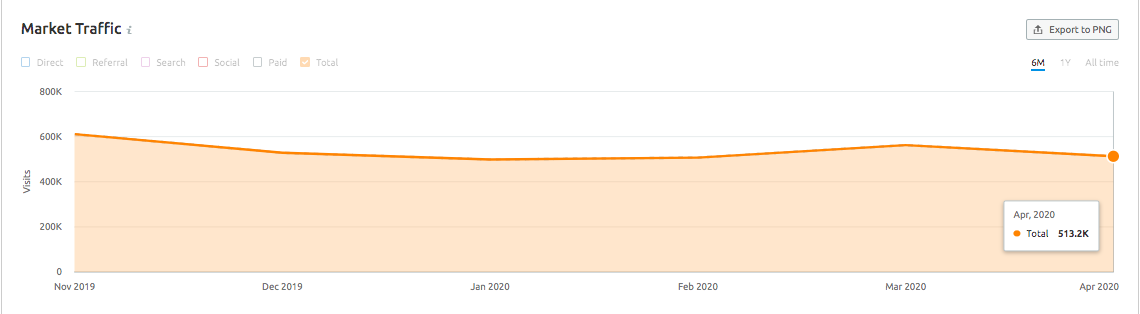

Looking at the coffee market comparison between November 2019 and April 2020. There is a slight decline of 16% between the November 2019 and April 2020 traffic.

November is the peak in coffee consumption because of Thanksgiving, Christmas Shopping, online events such as Black Friday, 11/11. And all these are reasons for the much higher traffic.

What is important to take into account is, in April 2020, Singapore is in lockdown situation due to COVID-19, the overall sentiment are gloomy with prospects of a recession and job loss. But yet, the traffic online still holds steady.

At an average of more half a million traffic, this market is attractive. What makes it more attractive is over a 6 months period and even during COVID-19, one of the worst calamity in human history, the traffic is consistent, showcasing the sustainability of this market.

2. Is there any change to the competitive landscape?

The change in the competitive landscape happens because of the change in the environment. From February 2020, people are encouraged to work from home. So instead of going online to pre-order drinks from places such as Starbucks or Coffee Bean Tea Leaf, some consumers bought coffee subscription package or the various home brewing solutions.

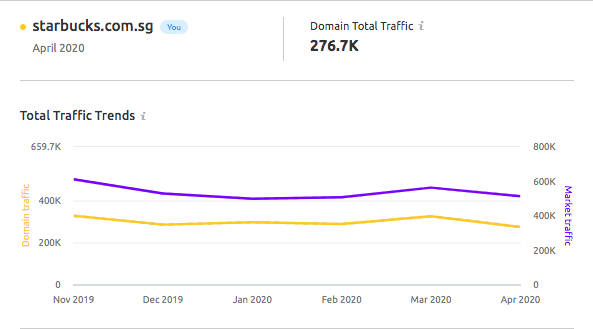

Depending on the narrative and marketing of the coffee shop, the overall traffic for coffee shops did not drop significantly. Using Starbucks as a case study, as seen in the graph below, Starbucks overall traffic chart is consistent with the market.

For Starbucks, the venture with Nestle to market their brands should protect the overall annual sales of their branded coffee products from the negative impact of COVID-19 (Starbucks receives a royalty from sales by Nestle). If the traffic translates to sales, Starbucks annual store sales should hold steady, and with Starbucks capsules being available on Dolce Gusto, Starbucks will enjoy sales through this channel as well.

In the image below, Starbucks can look forward to generating sales through its own asset and also Dolce Gusto. Check out some of our recommended marketing ideas to learn more about collaboration and leveraging from industry partners.

3. It is possible to compete in a competitive branded coffee shop market?

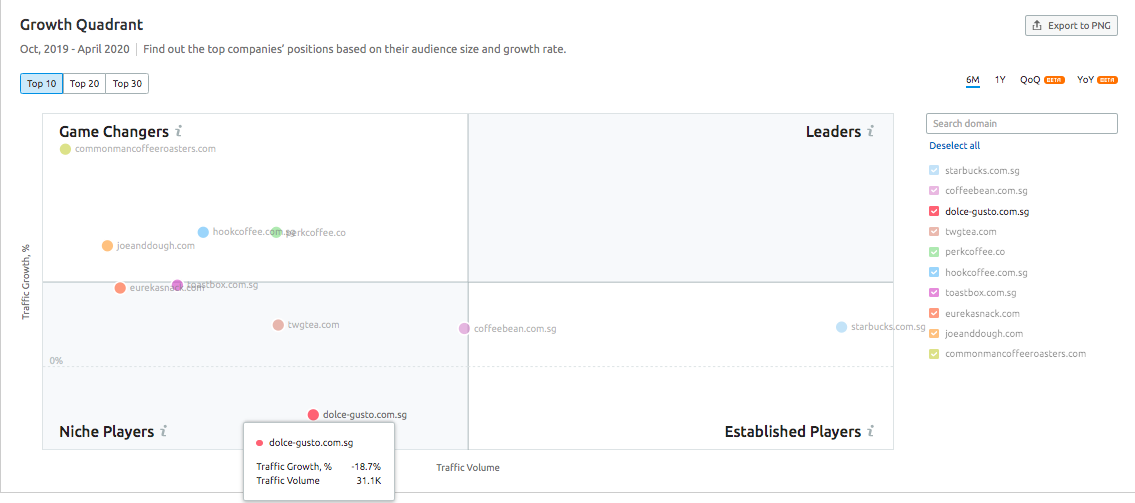

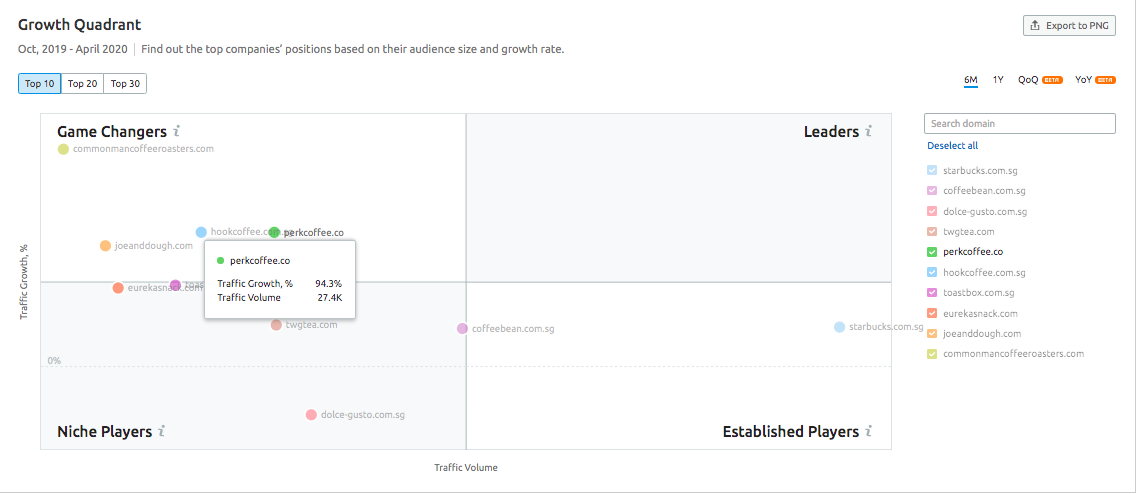

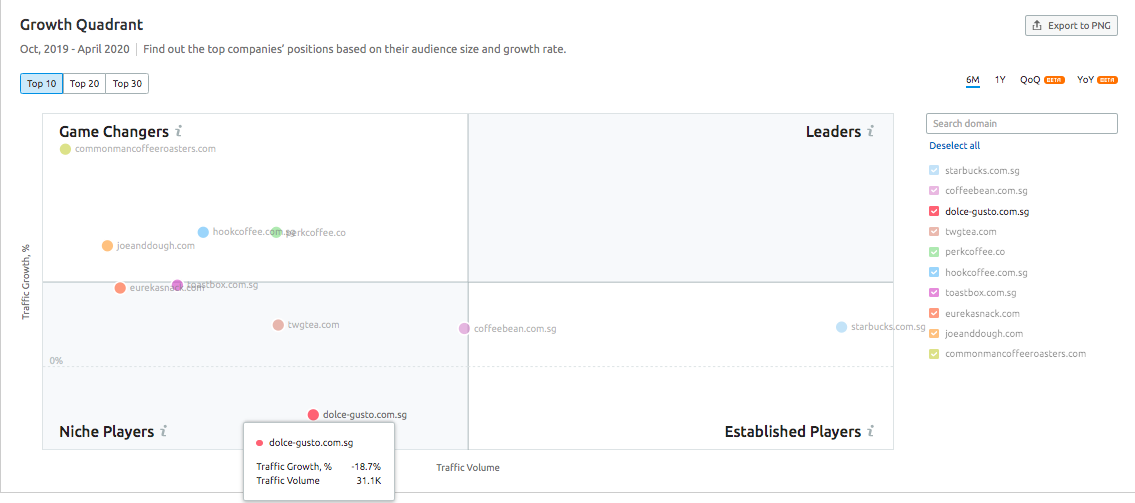

Perk is a local coffee supplier, if you look at two images below, you will see that the difference between Perk and Dolce Gusto (owned by Nestle), the difference in traffic is not big.

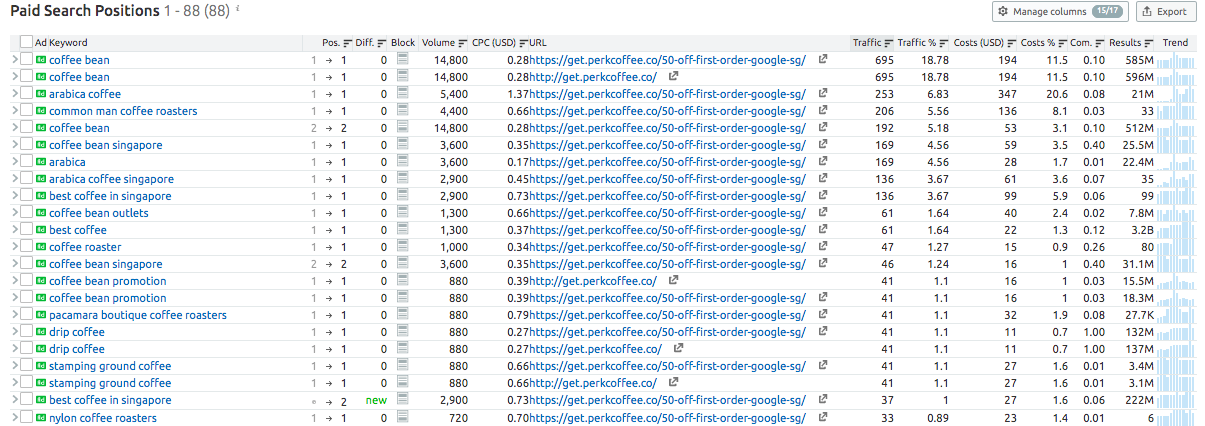

With SEM and PPC (online advertisement buying), the secret lies in how best one optimise the resources.

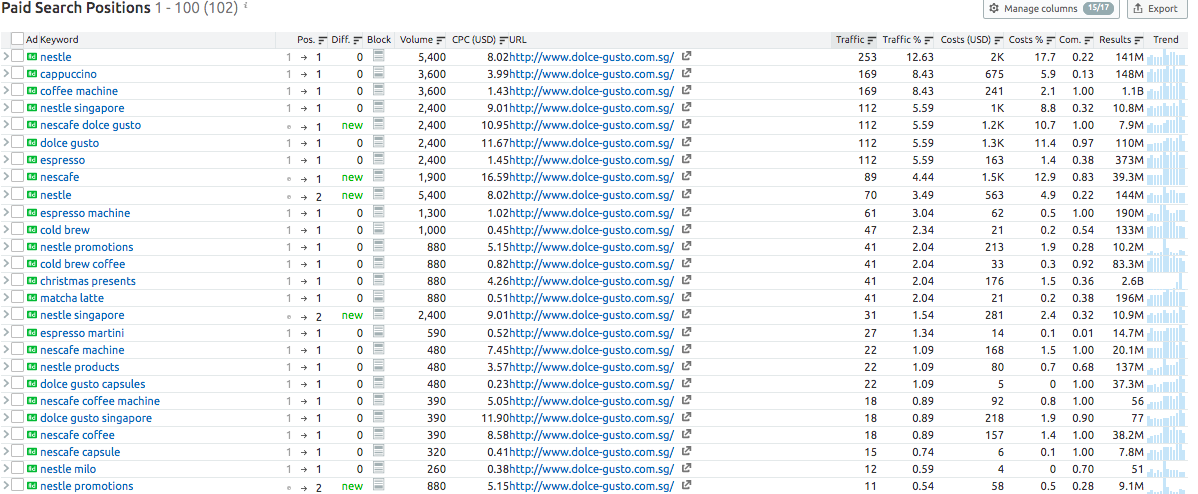

In the image below, you will notice that Dolce Gusto is buying mainly Nestle related keywords. We do not know the reasons behind the purchase of such keywords, but the purchase is quite costly. The keywords “Nestle and Nestle Singapore” costs them more than USD3000.

For that USD3000, Perk could have bought many other keywords, driving more traffic. This amount is enough for them to buy 15 more sets of “Coffee Beans”. For Perk though, they are buying coffee-related keywords.

By selecting and optimising their keywords list, Perks can spend lesser advertising budget but get more traffic.

The comparison above shows that it is possible for coffee companies to compete and drive decent traffic to their asset, even in this highly competitive landscape.

To sum up: the coffee market online is not only attractive, it is sustainable. Although there are changes to the coffee consumption, there are gaps for coffee companies that is willing to spend time to delve into analytics (keywords) and optimise their resources.

For companies who will like to find out more about coffee shops market share, you can:

Generate a free report using the platform that we used, or

Drop us a message below for us to assist you with 1 set of research.

Observation: Starbucks Target Maket

About US | OCM Profile

OCM (OnCoffeeMakers.com) was started in 2007 with the first webpage about coffee machines. And for a number of years, we focused on helping people find their desired coffee machine (we still are helping folks with that! So, if you are looking for coffee machines for office or restaurants - check out the link).

In 2010, we started getting enquiries on restaurant marketing and we start to help food and beverage brands with their marketing. Below are campaigns and events that we have done over the years:

OCM's campaigns: F&B Marketing Ideas by OCM

OCM's Events: F&B Industry events by or with OCM

Check out this restaurant marketing guide to learn more about the many campaigns and companies we have worked with.

Since then, we have also created many marketing workshops and classes for the F&B industry. Many of these modules are still running in tertiary institutions such as Temasek Polytechnic Skillsfuture Academy and also ITE College East COC classes, below are some snippets of our lectures and workshops:

OCM’s F&B workshops: Food and Beverage Marketing Lectures | Workshops - click to watch classes on customer journey map, JTBD and more.

So, if you are looking for industry practitioners to help you scale your coffee or F&B businesses, do drop us a message or book an appointment. Do also check out our various social media platforms on regular F&B and coffee market updates:

For regular coffee (F&B) related videos: OCM Youtube

For Daily Coffee Inspiration (fun coffee content): OCM IG

For insights into the coffee (F&B) industry: OCM LinkedIN

PS: For the coffee lovers, we continue to share coffee articles (and videos) and have also started a free coffee class section (with free online coffee training supported by coffee partners).

Looking for new Restaurants Marketing ideas?

Learn about latest marketing tactics for restaurants (involving Augmented Reality, Chatbot, Cross Channel Marketing).